The Bank of England halts increases in interest rates, while multiple European nations emerge from a period of economic decline.

The Bank of England (BoE) is projected to maintain an interest rate of 5.25 per cent, which is at a 15-year high, due to concerns about the UK’s uncertain economic future.

Economists at Threadneedle Street have been discussing more frequently in recent months the possibility of the country entering a recession.

During the last meeting of the Bank’s Monetary Policy Committee (MPC) in September, it was announced that the forecast for the third quarter of 2023 had been downgraded. The committee predicted a GDP growth of only 0.1%, which is lower than the previous forecast of 0.4% made just a month ago.

Keeping the interest rate at 5.25 percent will be beneficial for homeowners, as higher rates mean higher borrowing costs.

According to Investec economist Sandra Horsfield, the members of the MPC may choose to increase rates, however, she also stated that “the argument for raising rates currently appears less strong to us compared to the previous meeting.”

She highlighted the latest economic indicators, such as below-expected inflation in September, lower GDP compared to previous predictions, and poor retail sales and consumer sentiment.

As the Bank of England’s interest rate decision draws near, confidence in the business sector takes a nosedive.

According to recent findings from the Grant Thornton Business Outlook Tracker, companies are experiencing a sense of pessimism as the colder months approach and the Bank of England prepares to make another interest rate determination.

The most recent study of 600 medium-sized businesses in the UK reveals that, despite a decrease in inflation, these businesses have become less optimistic about their potential revenue growth for the next six months. This is the lowest level of confidence seen since October of last year.

The percentage of companies with a negative outlook on their growth has increased by over two times, rising from 5% in August to 11% among those surveyed.

Due to the current high interest rates and the expectation that they will continue to remain high, businesses have become less confident in their ability to secure funding. This has resulted in a decrease of 24 percentage points since August, reaching the second lowest level ever recorded by the Tracker. Furthermore, the number of individuals who hold a pessimistic view of their funding position has more than doubled, increasing from 5 percent to 12 percent.

According to Schellion Horn, the Head of Economic Consulting at Grant Thornton UK LLP, the level of optimism has stayed relatively high in our Tracker for the last 18 months, despite the economic difficulties. However, this may be attributed to the fact that many businesses had secured their funding. It is possible that the current high interest rates are now causing significant impact.

The cost of funding is increasing and agreements are becoming more strict, causing businesses to feel the pressure. Although a decision on interest rates is expected today, it is unlikely that they will decrease anytime soon due to unexpected inflation slowdown in September.

The economist believes that it is unlikely for policymakers to approve an increase in interest rates.

According to ING’s developed markets economist, James Smith, it is improbable that a majority of policymakers will approve an increase this month.

“According to Mr. Smith, one committee member changing their stance could potentially sway the decision towards more strict measures, but we are skeptical.”

According to him, there hasn’t been much new information since the previous vote, so those who opposed raising rates are unlikely to alter their opinions. He also mentioned that one of the previous voters in favor of raising rates, Jon Cunliffe, is no longer part of the MPC.

A leading accountant suggests that interest rates are currently excessively high and should be reduced.

Richard Murphy, an economist and Professor of Chartered Accounting Practice at the Sheffield University, said that

The current conversation surrounding the Bank of England’s interest rate decision is centered on whether they will maintain the rates or raise them, but this overlooks the crucial aspect of what is necessary at this time.

It is highly likely that the Bank of England has already responded excessively to the current inflation, resulting in interest rates being too high.

The combination of this fact and the deliberate increase in current financial market interest rates through quantitative tightening is causing significant harm to the economy, businesses, households, and individuals.

We require immediate and substantial reductions in interest rates to lessen the damage that has already been done and to support businesses, households with mortgages, renters, local governments, and others who are now facing financial instability. However, it is doubtful that the Bank of England will take action. It seems as though they are indifferent to the situation.

What is the current situation regarding housing costs?

The housing market saw an average increase of 0.9% in October compared to the previous month. This is likely due to a limited number of available properties for potential buyers, according to a report released on Wednesday.

Nationwide reported that the average house price in the UK for October was £259,423, which is a 3.3 percent decrease from the previous year.

According to Robert Gardner, the chief economist at Nationwide, although there was an increase in house prices from the previous month, the housing market has not been performing well. In September, only 43,300 mortgages were approved for purchasing a house, which is about 30% lower than the average monthly approvals in 2019.

He stated: “The increase in housing prices during October is likely due to a limited availability of properties for sale.”

”

There is minimal evidence of mandatory liquidation, which could decrease prices, due to stable job market conditions and historically low rates of unpaid mortgages.

“In the upcoming months, it is anticipated that there will be a lack of activity and stability in house prices.”

He stated that due to the Bank of England’s base rate not projected to decrease significantly in the future, borrowing expenses are not likely to revert back to the record lows experienced after the pandemic.

The economist suggests that Sunak’s lack of popularity may have an impact on the decision made by the Bank.

Today’s decision may be influenced by the unpopularity of Rishi Sunak, according to Althea Spinozzi, a senior fixed income strategist at investment platform Saxo.

She stated that the economic strategies of the government are still unclear due to Rishi Sunak’s declining popularity, which could contribute to an increase in inflation. This implies that the Prime Minister, in desperation, may consider reducing taxes to gain votes.

“In this current situation, the BoE’s credibility is at risk of being lost. The tightening of the economy was done too gradually and insufficiently. Governor Andrew Bailey has no choice but to continue promoting the idea of keeping interest rates higher for an extended period, hoping to maintain a hawkish stance. However, it is becoming increasingly clear that policymakers are hesitant to make any significant changes.”

The Unite union is urging the Bank of England to lower interest rates in order to assist struggling employees.

The labor union Unite has accused the Bank of England of negatively impacting the standard of living for workers and is urging them to lower interest rates.

The MPC, in charge of determining interest rates, will announce its decision today at noon.

Sharon Graham, the general secretary of Unite, stated: “The actions of the Bank of England have been harming the livelihoods of workers, while the banks continue to earn billions from two consecutive years of increased interest rates. This must come to an end. The surge in inflation is not a result of workers’ actions, but rather the greed of profiteers.”

The four major companies are taking advantage of employees to give profits to shareholders. It is necessary for the Bank of England to take measures against the true perpetrators of this issue with the cost of living.

Sharon Graham, the general secretary of Unite union, is urging the BoE to lower interest rates today (Jacob King/PA).

The Bank of England is facing a difficult decision.

Nick Brooks, the leader of Economic and Investment Research at ICG, believes that the BoE is in a difficult situation due to a decrease in economic growth while inflation remains high.

-

The Bank of England is expected to maintain its benchmark interest rate at 5.25% and highlight that any future decisions will be based on data.

-

The challenge for the Bank of England is that while the economy is experiencing a decrease in growth, the inflation rate in the UK remains the highest among other advanced nations and is proving to be difficult to lower.

-

As long as the job market remains tight, the BoE will probably have to maintain current interest rates, and there is a possibility that they may have to raise rates even more in the near future.

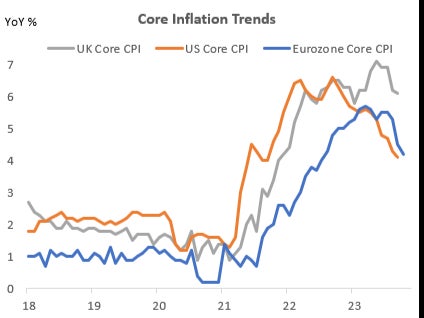

The rate of inflation in the UK is significantly higher compared to that of the US and Eurozone countries.

What is the effect of interest rates on mortgages?

Changes in the Bank of England’s base rate, which is the interest rate at which high street banks borrow from Threadneedle Street, has a knock-on effect on the interest rates that the former then set their mortgage borrowers.

These modifications will impact individuals who have savings as well as those who are borrowing funds from banks.

Can you explain the concept of interest rates?

An interest rate is a metric that indicates the cost of borrowing money or the benefits of saving.

When you borrow money, usually from a bank, the interest rate is the fee you will pay for borrowing it.

This fee is an additional cost on the total loan amount and will be indicated as a percentage of the total.

A larger percentage equates to a higher cost for borrowing funds from the lender.

If you deposit money into a bank account, the interest rate determines the additional amount you will earn on your savings. Banks typically pay a percentage of your total savings at the end of the year.

The Bank of England is anticipated to make an announcement at 12:00 PM.

Welcome to our live blog for the Bank of England (BoE), where we will provide updates and analysis on the upcoming interest rates announcement at 12pm.

Economists are predicting that the Bank of England will maintain interest rates at 5.25% due to worries about the potential for a recession in the UK economy.

In September, the Bank of England maintained interest rates at 5.25%, marking the first time in almost two years that they did not increase rates after 14 consecutive hikes.

Source: independent.co.uk