The FTSE 100 has opened down again after Asian markets plummeted as fears of a global trade war led investors to ramp up bets on the risk of recession.

Monday’s rout extends a two-day sell-off that wiped trillions of dollars from equity values after Donald Trump’s administration announced sweeping tariffs last week.

The US president said overnight on Monday that he did not want global markets to fall, but also that he was not concerned about the major sell-off, adding: “Sometimes you have to take medicine to fix something.”

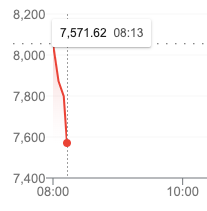

Global markets are braced for another dire day as the UK’s FTSE 100 index plunged more than 5 per cent within the first 10 minutes of trading.

Hong Kong’s Hang Seng index slumped more than 12 per cent in morning trade, which, if sustained, would make for the benchmark’s largest daily fall since the 2008 global financial crisis. China’s CSI300 blue-chip index fell more than 5 per cent, while Japan’s Nikkei 225 index plunged nearly 9 per cent, and Australia’s S&P/ASX 200 dropped more than 6 per cent, with South Korea’s Kospi losing 4.4 per cent.

UK prime minister Sir Keir Starmer said the “world as we knew it has gone” in the wake of Mr Trump’s tariffs.

China sovereign fund Huijin working to stabilise the market, state media says

China’s sovereign fund Central Huijin is actively taking measures to stabilise the capital market, the official Securities Times said on Monday, citing sources.

Chinese and Hong Kong stocks dived on Monday after Beijing fired back at US tariffs with its own trade levies, sowing more turmoil in financial markets as investors feared a widening trade war would unleash a deep recession.

Transports secretary admits government is ‘asking a lot of businesses at the moment’

The transport secretary acknowledged the government was “asking a lot of businesses at the moment” when asked whether it was unfortunate timing that an increase in employer national insurance had just come into force.

Heidi Alexander told Sky News: “So we’ve been very clear about why we have had to ask businesses to deal with increased employers’ national insurance contributions.

“It’s absolutely vital that we got the additional investment into the NHS, £26 billion extra going into the NHS, which has seen waiting lists for hospital appointments fall for the last five months in a row.

“And so we realise that we’re asking a lot of businesses at the moment. I would just point out that 43% of employers won’t pay national insurance contributions this year.

“We did make some changes to support the smallest businesses, but it’s absolutely vital if we’re going to get that investment in our public services, which is the mandate that we were elected on at the last election, we have had to be clear about where that money is coming from.”

She reiterated that the Government’s commitment to its fiscal rules is “non-negotiable”.

China accuses US of unilateralism, protectionism and economic bullying over tariffs

China has accused the US of unilateralism, protectionism and economic bullying over tariffs.

China’s CSI300 blue-chip index fell more than 5 per cent on Monday morning with selling in nearly every sector, while China’s yuan slipped to its lowest value since January and bonds rallied sharply.

Beijing is facing a combined 54 per cent tariffs on US exports, and announced retaliatory measures on Friday – which was a public holiday.

China warns Trump: ‘Threats and pressure are not right way’

China’s foreign ministry has warned Donal Trump that “threats and pressure are not the right way to deal with China”.

It also said on Monday that the US president’s sweeping tariffs only serve his country’s “own interest at the expense of other countries”.

Spain pushes to expand aid plan for industries hit by US tariffs

Spanish Economy Minister Carlos Cuerpo said on Monday he would push the European Union to approve aid for industries hit by US tariffs at a meeting of EU finance ministers to be held that day.

Spain on Thursday was one of the few major economies to offer up a concrete solution to help weather the impact of new US tariffs, offering its companies a financial package of loans and direct aid worth €14.1 billion ($15.54 billion).

European Union countries will seek to present a united front against US President Donald Trump’s tariffs, likely approving a first set of targeted countermeasures on up to $28 billion of U.S. imports.

The 27-nation bloc faces 25 per cent import tariffs on steel and aluminium and cars and “reciprocal” tariffs of 20 per cent from Wednesday for almost all other goods.

Mr Cuerpo also said the EU ministers will discuss a list of products to be submitted to retaliatory tariffs in response to the ones on steel, aluminium and cars.

Ireland sees EU consensus for ‘calm, measured’ response to Trump tariffs

Ireland’s trade minister has said he believes there is a strong consensus among European Union countries for a “calm, measured” response to US President Donald Trump’s tariffs and that US digital services will not be targeted at this point.

“I’ve spoken to most of my European counterparts… and my strong sense now is that the majority view by some distance is to take a calm, measured response and to try and get the US to the table,” Simon Harris told Newstalk Radio on Monday.

Targeting digital services is “highly unlikely at this stage,” he said.

Trump’s tariffs mean UK government looking at electric vehicle plans with ‘renewed urgency’

Donald Trump’s imposition of global tariffs means the UK Government has had to look at its electric vehicle plans with “renewed urgency”, the transport secretary has said.

Asked to what extent the package of changes announced on Monday has been influenced by the US president’s trade policy, Heidi Alexander told LBC: “So, the consultation on the zero-emission vehicles mandate started on Christmas Eve, and it closed in the middle of February, and so we were always planning to bring forward our response in April as a Government.

“Obviously what happened last week with the imposition of global tariffs by the US administration has meant that we have looked at this with renewed urgency in the last week, because, if you think about businesses like Jaguar Land Rover, their business planning has really been thrown up into the air given the amount of cars they export to the US.

“Because the car manufacturers have been saying to us ‘We need certainty on this’, it’s really important that we come forward with a sensible package urgently, which is what we are doing today, so that we can take that part of uncertainty away from their planning because we recognise it is a challenging time for a lot of businesses at the moment.”

Germany’s Dax share index plunges more than 7% in morning trading

Germany’s Dax share index has plunged more than 7 per cent in morning trading.

German shares dropped 7.25 half an hour into trading on Monday morning.

Billionaire Ackman, who endorsed Trump’s run for president, warns of ‘economic nuclear winter’

Billionaire fund manager Bill Ackman, who endorsed Trump’s run for president, called for the tariffs to be paused to avert an “economic nuclear winter”.

“The president is losing the confidence of business leaders around the globe,” he added.

FTSE 100 plunges more than 5% within first 10 minutes of trading

The FTSE 100 has plunged more than 5 per cent within the first 10 minutes of trading.

The UK’s benchmark dropped 5.73 per cent upon opening on Monday.

Source: independent.co.uk