Sign up for the View from Westminster email and get expert analysis delivered directly to your inbox.

Receive our complimentary Westminster View email.

According to a report from the Labour Party, Keir Starmer’s tax payment for last year was £99,431.

The summary indicated that almost half of the overall amount, which is £44,308, was paid towards income tax. In addition, the leader of the Labour party also gave £52,688 as capital gains tax after selling a portion of a field in December 2022. The field was jointly owned by the leader and his father’s estate.

Earlier, it was disclosed that Mr Starmer had sold a piece of property that he had purchased in the 1990s for his parents. They utilized the land to look after mistreated donkeys.

At the time, it was reported that the sale amounted to £400,000. The most recent tax summary shows that Mr. Starmer earned £275,739 from the sale of the land.

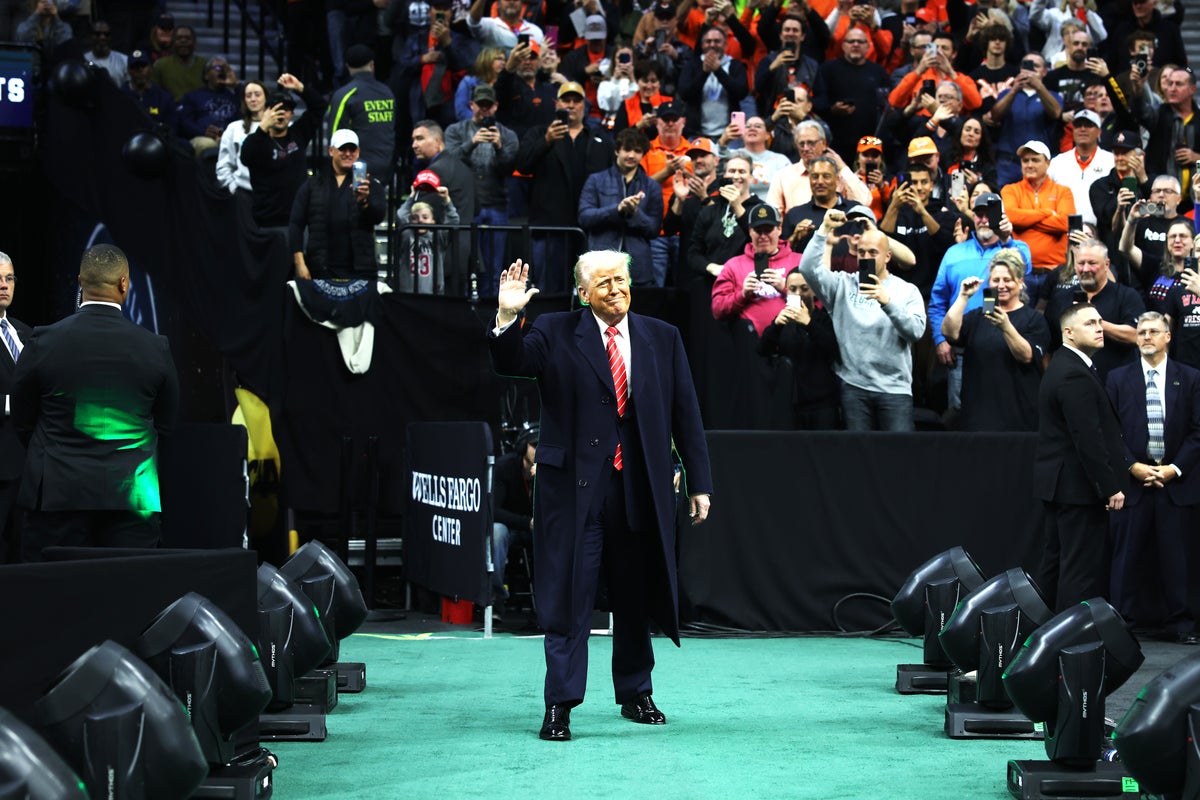

Sir Keir Starmer, the leader of the Labour party, has made public a condensed version of his most recent tax declaration. (Image credit: Joe Giddens/PA)

Earlier this month, Rishi Sunak released a summary of his personal tax records, revealing that he paid a total of £163,364 in taxes on an income of £432,884.

The Prime Minister also paid a total of £359,240 in taxes on approximately £1.8 million in capital gains from an investment fund based in the United States.

This was his second time disclosing his income since taking office as Prime Minister in October 2022, following Liz Truss.

Like Mr Sunak, the leader of the Labour party also released a “summary” of his taxable income, capital gains, and taxes paid for the previous tax year, as reported to HM Revenue & Customs. This information was prepared by his certified accountants.

The single-page record indicated that his earnings as an MP were £79,098, with an additional salary of £49,193 for his position as leader of the opposition, resulting in a total income of £128,291.

Source: independent.co.uk