Attorneys representing Donald Trump informed an appeals court that their client was unable to obtain a bond to pay off the $464 million civil fraud judgement placed against him by a New York court. They stated that finding a company willing to provide such a large sum of money was extremely challenging.

Donald Trump strongly opposes the idea of a quick sale of his business assets in order to raise money to pay off his debts. However, not taking this action could result in losing valuable properties like Trump Tower in New York City, which plays a significant role in his image. This would then allow Letitia James, the New York attorney general, to seize his assets, something she has expressed eagerness to do.

According to his attorneys, the previous leader and current expected Republican candidate for president has reached out to approximately 30 surety companies with the help of four different brokers. However, they have not had any success due to seemingly insurmountable challenges.

“Of the many difficulties facing, the most crucial is the widespread unwillingness of surety companies to issue a bond for such an unprecedented amount. Additionally, the defendants’ attempts to offer real estate as collateral have been met with resistance from all approached surety bond providers.”

According to the companies, they will only accept payment in cash or other assets that can be easily converted into cash, like stocks or bonds. They also stated that they would typically ask for collateral worth 120% of the judgment amount, which in this situation would be close to $560 million.

The lawyers suggest that the sureties will most likely charge a bond premium of about 2% annually, with an upfront cost of over $18 million, payable two years in advance.

Even if Mr. Trump were able to reverse the decision, the money would still not be able to be recovered.

Currently, the former wealthy real estate mogul who has now entered the world of politics has until March 25th to obtain the necessary funds to appeal a judgment made by Judge Arthur Engoron in February. The ruling states that he must pay approximately $355 million in fines, as well as an additional $100 million in interest after being convicted by a jury of deceptive practices. These practices involved misstating the worth of assets belonging to the Trump Organization in order to secure more favorable loans from banks and insurance companies between 2011 and 2021.

As of Wednesday, March 20, the helpful website Trump Debt Counter calculates that with a 9% interest rate or $120,000 per day, the current amount owed by Trump is $467.6 million.

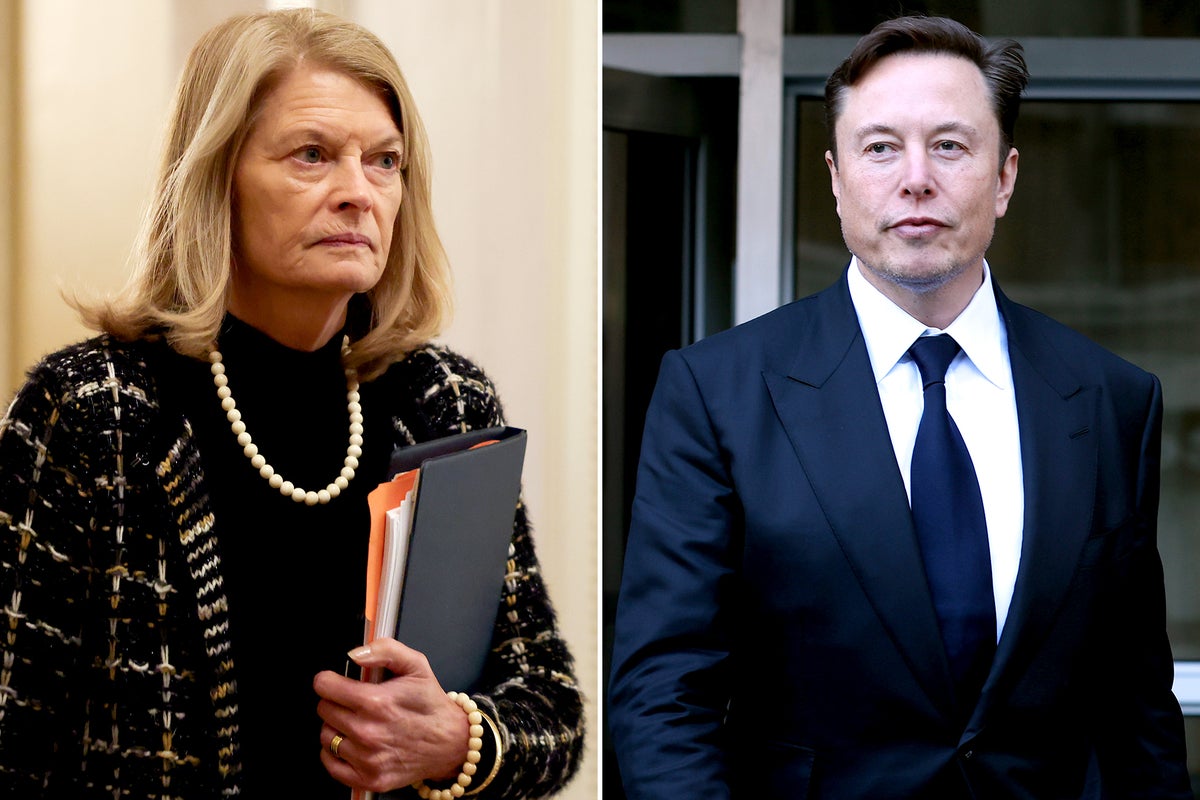

In 2022, New York attorney general Letitia James filed a lawsuit against the 45th president and his colleagues. Recently, her office requested that the appeals court dismiss Mr. Trump’s new objections.

On March 20th, Ms. James submitted a legal document stating that the court should disregard the defendant’s objections about not being able to meet his bond requirement, as they were made in an incorrect manner. She argued that he had sufficient time to bring up his concerns before.

She stated that the allegations of the Trump campaign can be summarized as the assertion that lenders have refused to use Mr. Trump’s real estate assets as security. However, the defendants have not provided any supporting documents that specify which real estate properties were offered to lenders, under what conditions they were offered, or the exact reasons for the lenders’ unwillingness to accept the assets.

Letitia James

Ms. James also contended that, even if the court were to agree with Mr. Trump’s assertion that real estate is not an ideal form of collateral for a bond, they had not presented a viable alternative.

The woman informed ABC News that if the individual is unable to pay the judgement amount, they will take legal action to enforce the judgement and request for the judge to confiscate his assets.

“We are ready to ensure that the court ruling is fulfilled for the benefit of New York residents, and I do see 40 Wall Street every day.”

Ms James’s office has begun implementing actions to reclaim some of the previous leader’s belongings, but not in Manhattan.

On 7 March, documents were filed stating that attorneys for the state have officially registered the verdict from the civil fraud case in Manhattan with the county clerk in Westchester County, where the former president owns the Seven Springs estate and Trump National Golf Club Westchester. This registration signifies that the attorney’s office has started the procedure of claiming ownership of Mr. Trump’s properties.

Because the civil fraud trial occurred in Manhattan, where Trump Tower and 40 Wall Street are situated, a ruling has been made in that jurisdiction. However, the large debts on these properties make it less likely that they will be susceptible to seizure.

In recent weeks, Mr. Trump obtained a $91.6 million bond that will allow him to challenge the defamation ruling made against him in the E Jean Carroll case. The bond was secured through the Federal Insurance Company, a subsidiary of the Chubb Corporation. Interestingly, the CEO of Chubb was also chosen to serve on a trade advisory committee during the Trump presidency.

This time, it seems that the same organization is not ready to assist him.

Demonstrators gathered outside Trump Tower in Manhattan.

The New York Post reported on March 20th that sources close to Trump believe he may choose to take no action instead of struggling to gather funds from businesses, wealthy acquaintances, or donors. Filing for Chapter 11 bankruptcy would not fully remove his debts from fraud and would weaken his claim of being a billionaire businessperson, potentially affecting his appeal to voters.

If his lawyers are unable to delay the implementation of the financial aspect of the decision, not meeting the 25 March deadline would allow Ms James to take possession of his bank accounts and property, such as Trump Tower where he famously rode down the golden escalator to announce his first presidential campaign in June 2015. This would leave Mr. Trump to risk whether or not he could regain his assets through an appeal to the US Supreme Court.

The newspaper was informed by a source from Trump’s team that just because something is taken does not necessarily mean that it cannot be returned later.

The article also cites another supporter of the previous president who claims that the individual is confident in his ability to reverse the ruling of fraudulent activities against him, stating that it could have negative consequences for those conducting business in New York, as it leaves them vulnerable to similar allegations.

They further state, “There will be significant repercussions, but it will not be an uprising. Individuals will refrain from conducting business in New York, and lenders are currently wary.”

“The state of the real estate market is currently catastrophic, as office buildings have lost a significant amount of their previous value. Moreover, relying heavily on real estate for a significant portion of the city’s budget can lead to further negative consequences.”

“Only time will tell” and “The clock is counting down.”

Source: independent.co.uk