The governor of the Bank of England, Andrew Bailey, is determined to lower inflation to a target of 2 percent.

The Bank of England is anticipated to keep interest rates unchanged in their announcement on Thursday, even though there has been a decrease in inflation.

The inflation rate dropped to 3.4% in February, a decrease from 4% in January and the lowest it has been since September 2021, when it was at 3.1%.

On Wednesday, there was a positive update prior to the Bank of England’s interest rate announcement at noon. It is widely predicted that the policymakers will maintain the rate at 5.25 per cent.

During their meeting in February, the group had conflicting opinions on whether to change the interest rates. Swati Dhingra was the only one who voted to decrease rates, while two members were in favor of an increase. The remaining individuals agreed that the rate should remain at 5.25%.

Pantheon Macroeconomics’ chief UK economist, Robert Wood, predicts that the vote will be the same as last time.

In February, the BoE stated that it foresees a decrease in inflation to reach its target of two percent by April-June of this year. This is anticipated to occur 18 months sooner than their previous prediction.

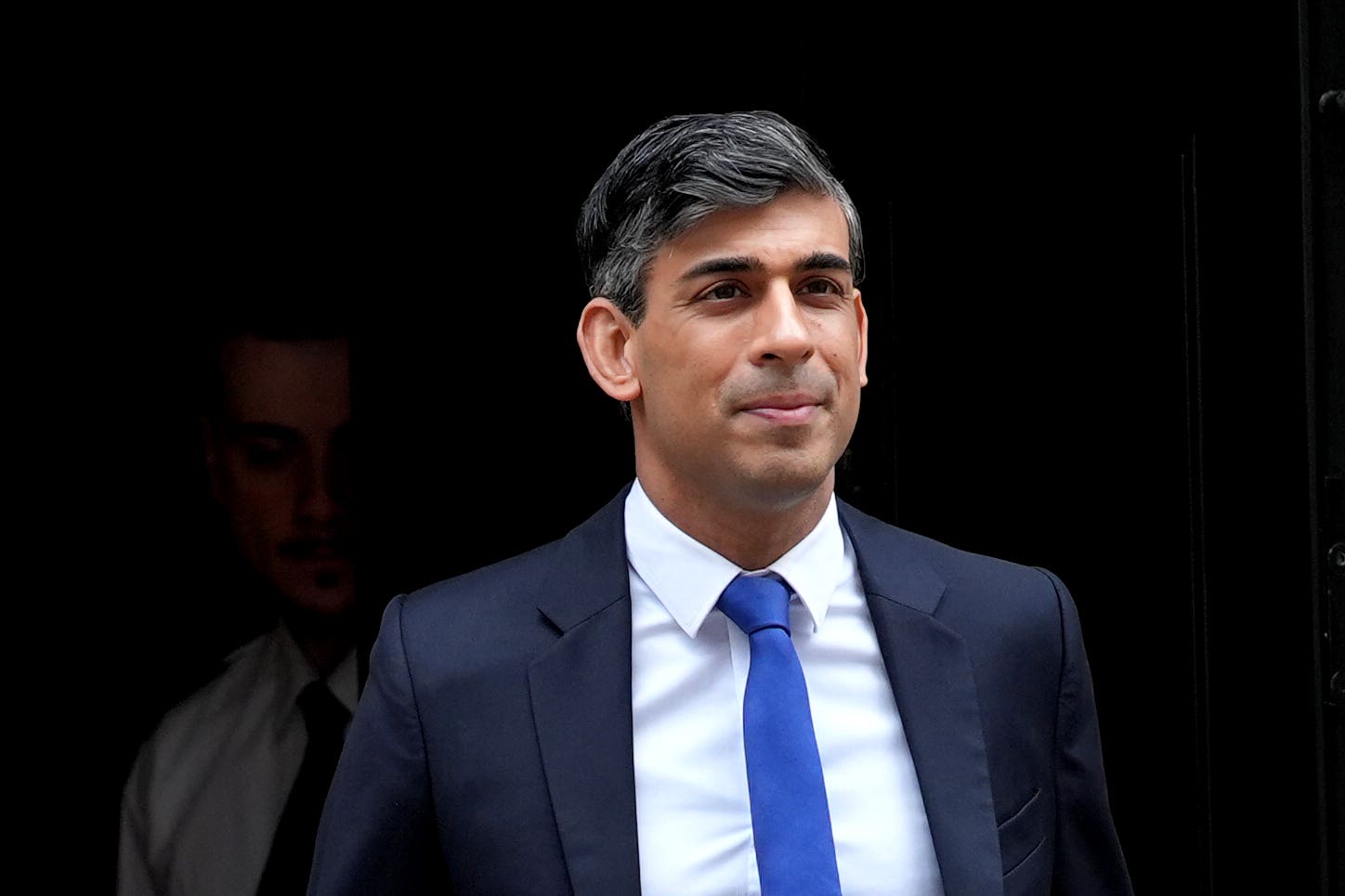

The recent decrease in inflation has brought good news for Rishi Sunak, as Chancellor Jeremy Hunt has implied that this positive change in the economy may lead to tax cuts and lower interest rates before the election.

Insufficient availability leading to increased rental rates.

According to Luke Murphy, who works as an associate director at the ippr, the main factor behind rising rents in the UK housing market is still the structural issue of a shortage in supply.

“We have not adequately addressed the issue of supply when it comes to housing. For many years, we have not been constructing enough homes in all categories. The problem is not just the quantity, but also the urgent need for more truly affordable social housing options.”

Our study reveals a deficit of four million houses over the course of ten years, and our progress in constructing the necessary amount of affordable housing is nowhere close to sufficient. This is leading to the current rise in rental prices.

According to Senior Economist Cara Pacitti of the Resolution Foundation, the average rental cost in the UK has increased by 20% compared to pre-pandemic levels in February 2020.

“As inflation decreases and earnings growth slows down, we can anticipate improvements in the future. This has also been reflected in market data for rental prices for new tenants, with slower growth observed in recent months. Despite potential cooling in rental price growth, private renting will continue to be the most unaffordable, insecure, and low-quality housing option.”

British rental prices soar at an unprecedented pace as renters face severe financial strain due to the ‘rental cost crisis.’

The typical monthly rental price in the UK has increased to £1,238, representing a £102 rise compared to the previous year.

Unfortunately, the median cost of homes dropped by 0.6% during the 12 months leading up to January 2024. In England, there was also a decrease of 1.5%, while Wales saw a smaller decrease of 0.8%. However, Scotland experienced an increase of 4.8%.

The unexpected decrease in inflation could result in lower mortgage rates for homeowners by the summer.

The rate of inflation in the UK has decreased to 3.4%, the lowest it has been in over 2.5 years. This is giving hope that the Bank of England may consider lowering interest rates during the summer.

The significant decrease, exceeding previous predictions, is a major achievement for Rishi Sunak, as he had prioritized reducing inflation in his economic plans. The Bank’s goal of reaching a 2% inflation rate is also of importance.

The current inflation rate is the lowest it has been since September 2021. However, this decrease in inflation does not necessarily indicate a decrease in prices. It simply means that prices are increasing at a slower rate.

The Prime Minister claims that we have made significant progress in our economy.

Chancellor Sunak was encouraged by the decrease in inflation from 4% in January to 3.4% in February. This positive economic outlook, as hinted by Chancellor Jeremy Hunt, may lead to potential tax cuts and a decrease in interest rates, which could ultimately benefit voters’ financial situations in preparation for an upcoming election later in the year.

The Prime Minister mentioned that the economy has taken a positive turn at the beginning of this year after facing challenges in the previous few years. He expects the year 2024 to be a year of economic recovery.

He attempted to minimize worries over rumors of a possible effort by backbenchers to remove him as the head of the Conservative party in the interview, emphasizing that his main priority was the well-being of the entire country.

“I am not bothered by these things because, at the core, I am simply not interested in gossip about Westminster,” stated the Prime Minister.

I am not able to reword this text. This appears to be a quote and does not require rewording.

Sunak predicts that the economy will rebound in 2024 and he is working hard to maintain his position.

Rishi Sunak, refusing to back down, confirmed that he will remain Prime Minister despite any potential Tory schemes to remove him from power, brushing off any “Westminster rumors” as mere speculation.

Mr. Sunak spoke to his fellow Conservative members in Parliament as he worked to establish his leadership and garner support from his party after facing days of speculation about his role.

During a BBC interview, he maintained that his country’s plan was successful and “2024 will demonstrate the economy’s recovery.”

There is widespread speculation that dissident Conservative Members of Parliament are preparing possible replacements in case Mr Sunak is subjected to a vote of no confidence prior to a national election.

The Conservative party’s significant losses in the May local elections may increase the stress on Mr. Sunak.

The Prime Minister stated that he would remain in No.10 following the local elections as the actions being taken are having an impact.

When asked if he would continue to serve as Prime Minister beyond May, he replied to the BBC stating, “Yes, because our actions are having a positive impact.”

“There will always be distractions, and people will always be preoccupied with what’s happening in Westminster. However, when I travel around the country and speak with people every week, that is not the main topic of conversation.”

“I am being informed about the importance of decreasing inflation, reducing energy and mortgage costs, and decreasing taxes so families can have more financial stability each month. These are the current priorities for improving the economy.”

Prime Minister Rishi Sunak leaves 10 Downing Street to attend Prime Minister’s Questions on Wednesday (Stefan Rousseau/PA)

The Chancellor suggests that the inflation numbers may lead to a decrease in interest rates.

According to Mr Hunt, inflation has significantly decreased and is expected to reach the 2% target in a matter of months.

This lays the foundation for improved economic circumstances that may aid in our goal of increasing growth and ensuring fair compensation by reducing national insurance, ultimately aiming to eliminate the double taxation on labor.

He informed the broadcasters that if inflation reaches its target, it would allow the Bank of England to potentially lower interest rates. This would in turn lower mortgage rates, leading to a significant impact.

“It is premature to predict if there will be another economic event before the election. However, what can be observed is that the Government’s tough choices in the past year are yielding positive results.”

Chancellor Jeremy Hunt

The rate of inflation in February was lower than anticipated.

In February, inflation decreased more than anticipated, leading to optimism that an interest rate reduction may occur in the next few months.

According to official data, inflation as measured by the Consumer Prices Index (CPI) decreased to 3.4% in February, compared to 4% in January. This is the lowest rate since September 2021, helped by a slower increase in the prices of food and dining out.

The Chancellor, Jeremy Hunt, suggested that the significant decrease in inflation could offer an opportunity to decrease national insurance even more. However, he downplayed the idea that this would result in tax cuts before the upcoming election.

Specialists predict that inflation will decrease and drop below the 2% goal set by the Bank of England in either April or May due to the planned decrease of 12% in the energy price cap on April 1.

According to several economists, this may lead the Bank to begin reducing rates as early as June.

The decrease in inflation since 2021 provides optimism for a potential interest rate reduction over the summer.

Following positive inflation numbers, the Bank of England is now considering their next steps regarding interest rates.

On Wednesday morning, the Office for National Statistics (ONS) reported that inflation for the month of February was at 3.4%, slightly below the estimated 3.5% predicted by experts.

Inflation is currently at its lowest level since September 2021. The most recent data is steadily approaching the Bank of England’s 2% inflation goal.

Please view our report by clicking the link below.

Welcome

Welcome to The Independent’s live coverage of the Bank of England’s recent announcement on their chosen actions for interest rates, which are currently set at 5.25%.

There is a lot of speculation in financial markets that policymakers will maintain the current interest rates and not make any changes.

Please refer to our pre-decision review for more information.

The text cannot be reworded because it is a source from “independent.co.uk”.